In "Reminiscences of a Bond Operator," Mark A. Rieder, a veteran credit investor, unveils the intricacies of corporate debt investing. This comprehensive guide transcends typical financial texts, offering actionable strategies and in-depth case studies to navigate the complexities of global debt markets. Readers will learn rigorous research methods for analyzing corporate debt, master portfolio construction and management techniques to balance risk and reward, and discover how to identify lucrative credit opportunities. From understanding market dynamics to leveraging short-term inefficiencies for long-term gains, this book provides practical advice and step-by-step guidance for both seasoned investors and newcomers seeking to succeed in the challenging yet rewarding world of corporate debt.

Review Reminiscences of a Bond Operator

I was genuinely blown away by "Reminiscences of a Bond Operator." Going in, I had a vague understanding of bond investing, but Mark Rieder's book transformed that into a surprisingly clear and engaging picture of the entire landscape. It's not often you find a finance book that manages to be both deeply informative and incredibly readable, but this one achieves that feat effortlessly. Rieder's writing style is conversational and approachable, making complex concepts feel accessible, even to someone like myself who doesn't have a background in finance.

One of the things I appreciated most was the structure. The book expertly balances high-level overviews of debt markets with detailed, practical applications. It doesn't shy away from the technical aspects, but it presents them in a digestible way, building upon foundational knowledge before diving into more advanced topics. This gradual progression makes the learning curve surprisingly gentle, allowing you to build confidence as you progress. The inclusion of real-world case studies is invaluable; these examples vividly illustrate the concepts discussed, making them far more memorable and relatable. They aren't just theoretical exercises; they are snapshots of actual market situations, showing both successes and potential pitfalls.

The depth of coverage is another remarkable aspect. The book doesn't just skim the surface; it delves into the nitty-gritty of portfolio construction, risk management, and the research process involved in analyzing corporate debt. I especially appreciated the emphasis on actionable strategies. This isn't just a book to read passively; it's a guide designed to equip you with the tools and knowledge to make informed decisions. The practical tips and step-by-step guidance are extremely helpful, providing a clear roadmap for navigating the complexities of the bond market.

While the book is clearly beneficial for seasoned professionals – the insights and lessons learned from Rieder's extensive experience are invaluable – it's also perfectly suited for newcomers. The clear explanations and accessible language make it an excellent resource for anyone interested in learning more about corporate debt investing, regardless of their prior knowledge. The book even goes beyond the purely technical aspects, offering a glimpse into the day-to-day realities of working in the field, including insights into the interview process – a valuable bonus for those considering a career in fixed income.

Furthermore, I found the book's scope unexpectedly broad. While focused on fixed income, the principles discussed—particularly those related to cash flow analysis, leverage ratios, and understanding potential risks—are readily transferable to other investment areas like private equity. This unexpected cross-application greatly enhanced its value for me, extending its utility beyond its core subject matter. In short, "Reminiscences of a Bond Operator" is a compelling read that exceeded my expectations. It’s a valuable resource, a fascinating look into the world of bond investing, and a testament to Rieder's expertise and ability to communicate complex ideas clearly and concisely. I wholeheartedly recommend it to anyone with even a passing interest in finance, whether you're a seasoned investor or just beginning to explore the possibilities of the market. It's truly money well spent.

Information

- Dimensions: 6 x 0.71 x 9 inches

- Language: English

- Print length: 312

- Publication date: 2024

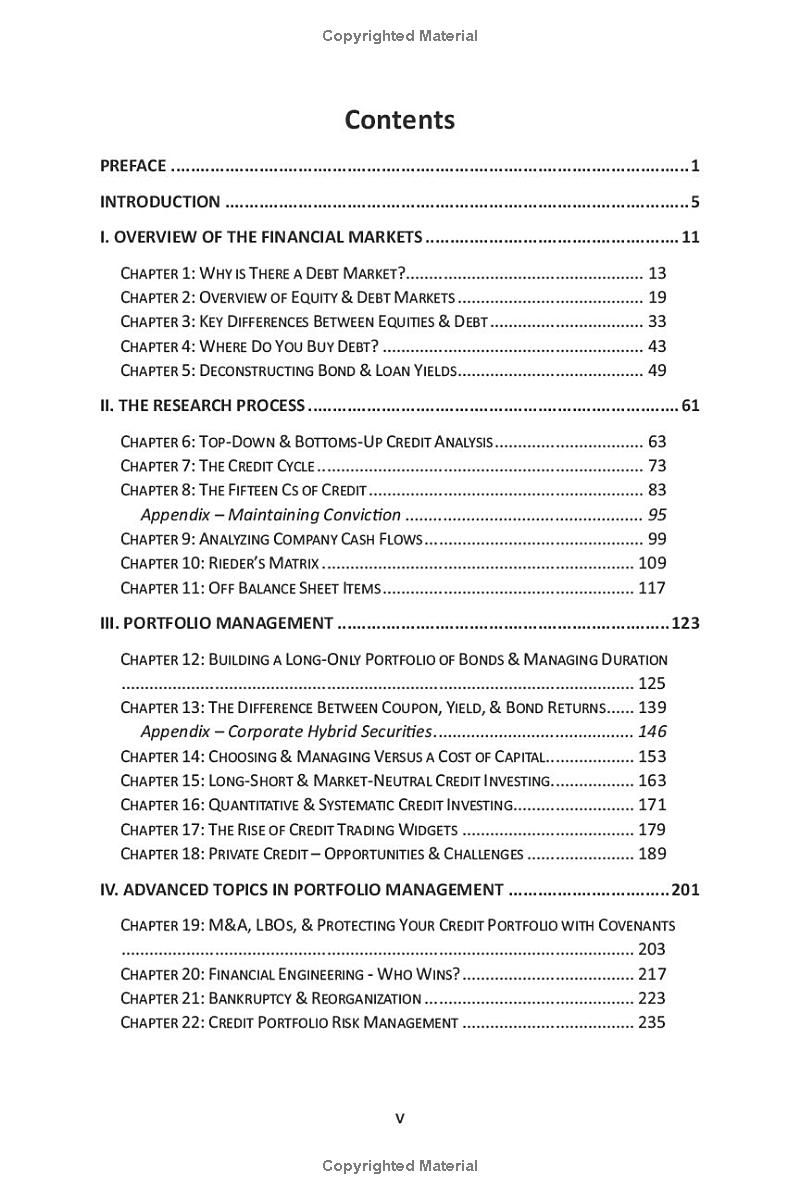

Book table of contents

- PREFACE

- INTRODUCTION

- 1 OVERVIEW OF THE FINANCIAL MARKETS

- CHAPTER 1: WHY IS THERE DEBT MARKET?

- CHAPTER 2: OVERVIEW OF EQUITY & DEBT MARKETS

- CHAPTER 3: KEY DIFFERENCES BETWEEN EQUITIES & DEBT

- CHAPTER 4: WHERE DO YOU BUY DEBT?

- CHAPTER 5: DECONSTRUCTING BOND & LOAN YIELDS

- II. THE RESEARCH PROCESS

- CHAPTER 6: TOP-DOWN & BOTTOMS-UP CREDIT ANALYSIS

- CHAPTER 7: THE CREDIT CYCLE

- CHAPTER 8: THE FIFTEEN CS OF CREDIT

- Appendix Maintaining Conviction

- CHAPTER 9: ANALYZING COMPANY CASH FLOWS

- CHAPTER 10: RIEDER'S MATRIX

Preview Book